Discover the Easy and Efficient Way to Manage Payroll and Compliance

Payroll management is one of the primary responsibilities of the HR team and a streamlined approach to avoid discrepancies and prevent delays. Payroll software is a critical aspect of any organization, as it involves the calculation and distribution of employee salaries. While payroll system may seem like a straightforward process, it can be quite complex and time-consuming, especially for larger organizations.

Some of the challenges associated with payroll include:

- Tracking employee work hours

- Calculating salaries

- Deducting taxes and other withholdings

- Ensuring compliance with tax laws and regulations

Overall, while payroll can be a complex and challenging process, it is an essential part of any organization's operations. Digital HRMS offers a payroll system and by staying up-to-date with tax laws and regulations, with its help, companies can ensure that their employees are paid accurately and on time while minimizing the risk of legal issues. It can decrease overhead costs by automating multiple processes and also there will be decreased employee grievances and many more features.

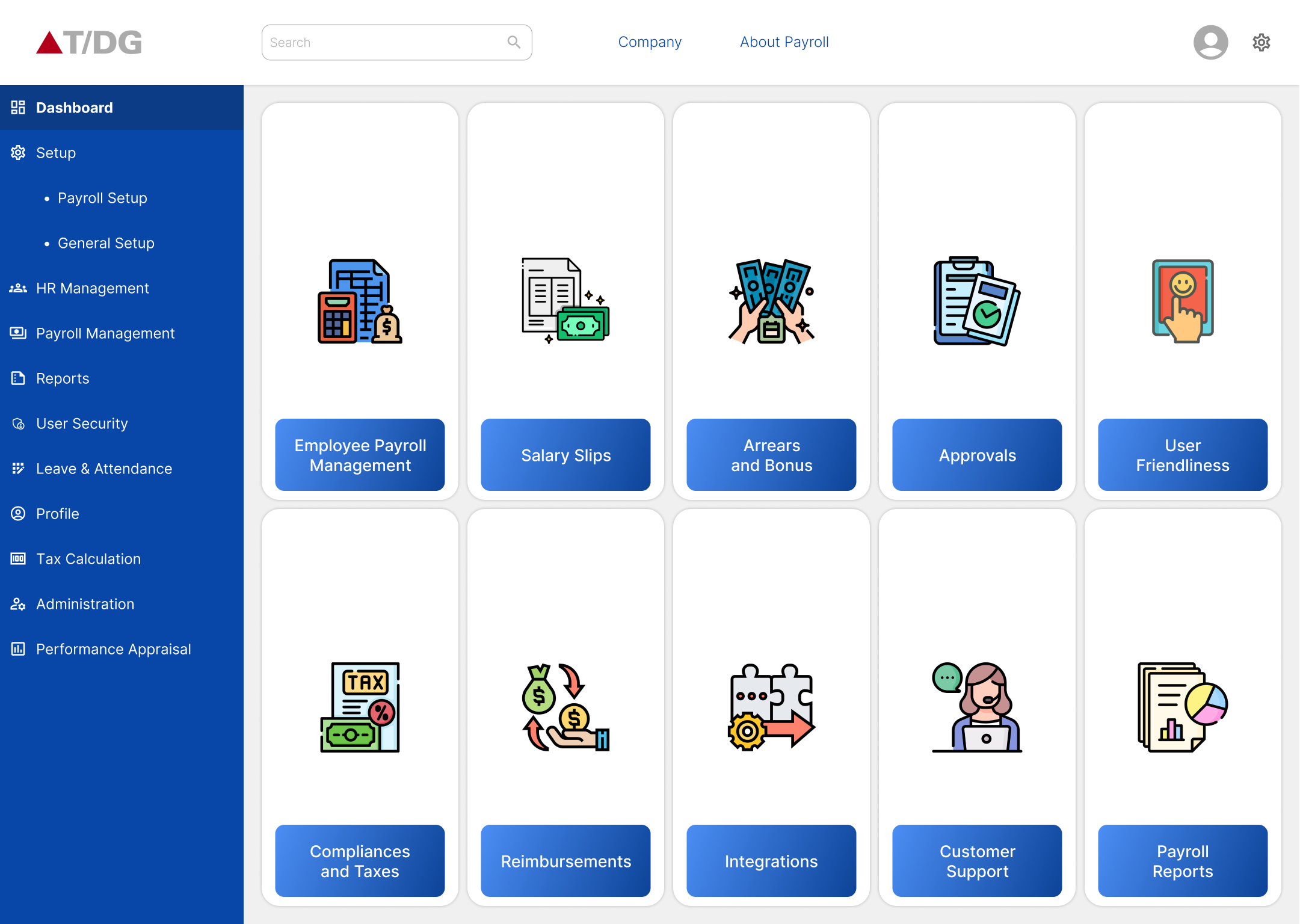

Choose Digital HRMS Payroll Management Platform - An Efficient Payroll Module with All Features

Choosing a payroll software can be a daunting task, but there are several factors to consider that can help you make a wise decision. Digital HRMS payroll module that offers the features you need to manage your payroll effectively and helps to ensure that your payroll processes are efficient, accurate, and compliant.

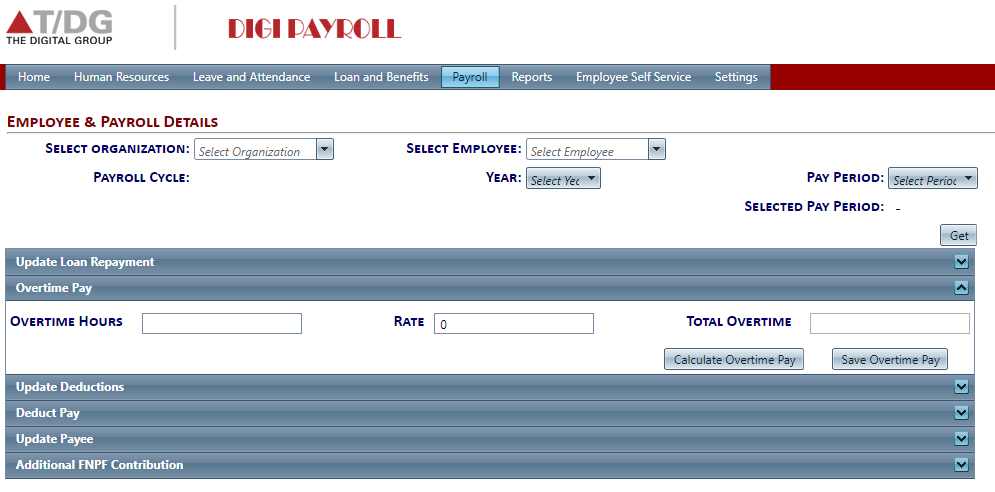

- Employee Payroll Management: This feature allows employers to store and manage employee information such as personal details, employment status, and tax information.

- Payroll Processing & Salary Slip: This feature calculates employee pay based on their work hours, and salary - Automated emails to employees with password-protected pay slips.

- Arrears and Bonus: It also calculates the arrears or bonuses applicable to employees.

- Approvals: The system automatically sends for approval from the authorities wherever required.

- Integration: Consider whether the payroll tool integrates with other systems you use, such as accounting or HR software.

- Compliance and Tax Management: The payroll software automatically calculates and withholds taxes from employee paychecks, as well as generates tax reports for employers. Payroll module is compliant with all relevant tax laws and regulations.

- Reimbursements: Employees can view their reimbursement status.

- Electronic EMS (Employer Monthly Summary): Online PF contribution submission permits the company to provide the employee with more PF and enables the employee to subtract more PF.

- User-friendliness: Look for a payroll management software that is easy to use and understand.

- Customer Support: Consider the level of customer support offered by the payroll module provider.

- Reporting and Analytics: Payroll management tool can generate a variety of reports and analytics related to employee pay, tax information, and other relevant data.

- Easy Integration: Payroll management can be integrated easily with other modules and can incorporate your country's taxation rules for easy processing and compliance.

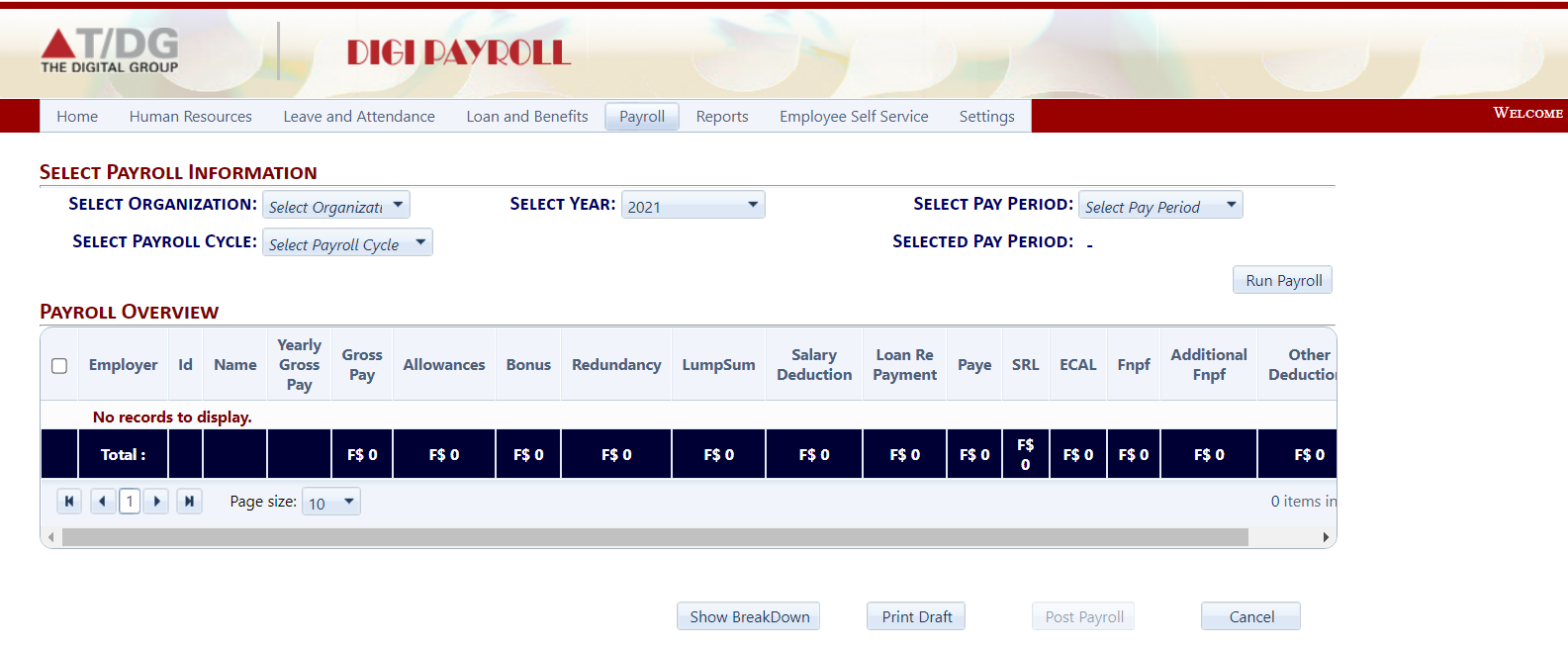

About Payroll in Fiji Region

We are successfully operating Payroll for our client based in Fiji to cater to the requirements. The Digital HRMS Payroll is a customizable payroll administration software with several advanced features that address key aspects of human resource management.

It has the following specific features -

- FRCS-accredited software, including FNPF compliance.

- Ring Fencing options available as per FRCS regulations.

- Online FNPF submission of monthly contribution.

- Support for additional FNPF contributions by employees & employer.

- Automated generation of monthly PAYE & FNPF Electronic EMS.

Our Clientele

Get Started with Digital HRMS Payroll Management System

Begin using Digital HRMS Payroll immediately for streamlined employee payroll management and guaranteed compliance with government rules.